In order to facilitate the supplies of face masks and of personal protective equipment and medical aids in general which are needed to deal with the health emergency, the emergency legislation has introduced new validation procedures for those devices. In particular, as concerns face masks the Cura Italia decree has made a distinction between…

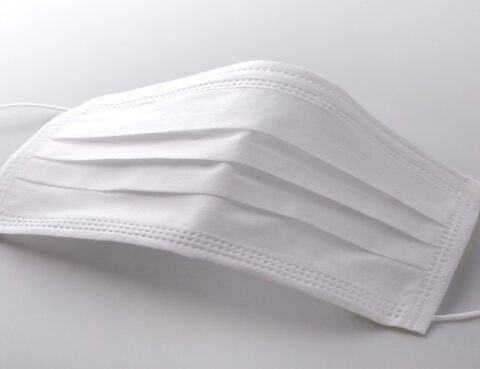

Due to the Covid emergency, the need for PPE (Personal Protective Equipment) and for face masks in particular has significantly increased. As is well known, since masks are difficult to find on the market at present they have become one of the most in demand products. Due to their limited availability their price has increased…

The Trieste Customs Authority contested the inapplicability of the reduced rate of the antidumping duty to some clients of the Firm (importer and freight forwarder acting as indirect representative), since even though the declaration on the invoice which accompanied the importation had all the data required by Annex II of Regulation EU 412/2013, it bore…

In a judgment that has recently become final, the Friuli Venezia Giulia Commissione Tributaria Regionale (Regional Tax Court) has further confirmed the continuing validity of the special rules governing the free zones of the port of Trieste, which override the national legislation that has subsequently intervened. The judgment underlines that the Free Port of Trieste…

As noted in our September 2015 and October 2015 newsletters, over the past months the Firm has obtained a series of injunctions through which the Tribunale di Trieste and the Tribunale di Gorizia have ordered Agenzia delle Dogane (Customs Agency) to release the guarantees issued by the customs brokers as security for goods warehoused for…

The Bench Court of Trieste has been requested to rule on the appeal filed by the Customs Authority against the injunction ordering the release of the amounts provided as a guarantee by the customs broker. The Court once again confirmed that, in the event of customs warehousing for VAT purposes, the customs broker is not…

With a very recent decision the Court of Trieste ordered the Customs Authority to immediately release the bank guarantee through which a customs broker had guaranteed the import operations by means of VAT warehouse. In the specific case the broker represented by the Firm saw to a series of shipments through a VAT warehouse. In…